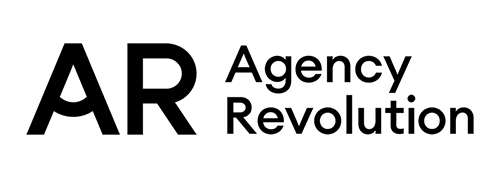

Your beautiful, new insurance agency website includes everything you need to look amazing, be found, sell more, and service better.

Forge lets you bring the wow factor.

Every Forge website is individually designed to reflect your agency, attract customers, and maximize conversions

Unlike websites built from a generic template, your new website will be a highly-optimized individualized website specifically built for your insurance agency. You’ll also immediately have access to innovative and proven sales tools to drive your success.

Our in-house experts will handle your insurance agency website from creation to launch and beyond, all backed by our years of experience, expertise, and creating excellent experiences.

Forge has it all.

74% of all insurance shoppers start by searching online. Make it easy for them to find you and be impressed.

Stand Out With Style

Showcase your agency with a modern, inviting website.

Attract Clients Effortlessly

See and be seen by the right audience.

Stand Out With Style

Showcase your agency with a modern, inviting website.

Attract Clients Effortlessly

See and be seen by the right audience.

Boost Your Sales

Access sales tools like you’ve never seen before.

Deliver Exceptional Service

Exceed client expectations with an outstanding experience.

Look Amazing

Your website should have a design that’s as impressive as your agency.

The Forge website platform was built exclusively for insurance agencies by experts with an agency background. We understand the industry and the needs of your prospects and clients. Forge can help you provide the information, value, and service the way only your agency can, backed by a powerful contemporary website.

Get Found

Your prospects have options. Make sure they find you.

Forge has all the elements to make your agency more likely to be found online by insurance shoppers. The informative, interactive content holds them on the site longer so they can learn what makes your agency unique.

Get Found on Google

The Forge platform is built using Google’s best practices for search engine optimization (SEO). All available content is optimized for search, as are the page structures, designs, platform features, and even the underlying code that you’ll never have to worry about.

Get More 5-Star Reviews

Capture feedback from clients using the integrated 5-Star Agency Review Form. It’s specifically designed to encourage 5-star reviews on Google, Facebook, and Yelp from your best supporters. This is great for search engine optimization too!

Boost Local Traffic

Improving your agency’s search ranking starts with the content of your website. We develop content unique to your agency while paying special attention to the areas you serve. Everything from location-specific pages to technical schema and SEO settings goes a long way.

Show Up in Local Directories

We can submit your agency to leading online directory services, including Google My Business, Apple Maps, Facebook, LinkedIn Company Directory, Bing, and Yelp. Ensuring you have consistent information displayed online can further help search engine optimization (SEO).

Sell More

Forge has revolutionary sales tools at your fingertips.

You’ll have access to the industry’s most innovative and proven sales tools. Clickable Coverage, Hello Producer, Video Proposals, Power Panels, and more are all included.

Most fires are devastating. Besides the emotional impact, the physical damage to your home can be significant. If you lost your home to fire, do you have adequate insurance to replace your home and its contents? Remember, inflation rates on building materials and construction costs rarely track with real estate values. As a result, rebuilding a home can often cost significantly more than expected.

Make sure your homeowners policy contains replacement cost coverage with no cap. This protects you if the cost to reconstruct your home is higher than your current limit of coverage. And, be sure that your insurance includes rebuilding your home to code. Very often, local ordinances and building codes change over time, which may require additional costs.

When your home suffers damage due to an unexpected event, your personal property is also at risk. Furniture, appliances, clothing, electronics, and other personal items can also be damaged or destroyed.

Your homeowners insurance policy typically covers personal property, including the contents of your home and other personal items owned by you or family members who live with you. Make sure your homeowners policy includes replacement cost coverage for personal property so that you always receive the full cost to replace whatever item is damaged.

When there is substantial damage to your home due to unexpected events such as lightning, fire, or a storm, you may not be able to live in your home until it can be repaired or rebuilt–potentially incurring additional living expenses for lodging, food, and other daily needs.

Ensure that your homeowners insurance policy provides additional living expense or loss of use coverage to compensate you for the additional costs you incur for reasonable housing and living expenses if a covered event makes your house temporarily uninhabitable while it's being repaired or rebuilt.

Typically, there is a sublimit on homeowner insurance policies for valuable possessions, such as jewelry, furs, fine arts, and other collectibles.

Obtain a personal floater or schedule your valuable possessions to ensure you’ll have the money to replace them.

If a guest is injured while on your property, even when it’s due to a friendly game of baseball, you may be required to pay any medical expenses associated with their injury.

Your homeowners policy should include medical expenses coverage to take care of injuries and treatment - generally not of a serious nature. In the event a person is injured on your property and requires medical attention, you would be able to submit the injury-related medical expenses to your insurance carrier. Medical expenses are usually paid without a liability claim being filed against you.

In the unfortunate event that someone slips and falls while on your property, you and your family may be held liable for any injuries that result.

Your homeowners policy includes personal liability coverage to respond to incidents where injuries or damages occur to a third party where you may be deemed negligent. However, you should consider purchasing a personal umbrella or excess liability policy to provide additional coverage limits to protect your assets in case a lawsuit is brought against you.

The fun that comes with having a trampoline in your backyard can also be accompanied by serious risks, which may not be covered under your standard homeowners insurance policy since coverage varies from state to state and between insurance companies.

You should make sure your homeowners insurance policy covers your trampoline, as many insurance providers refuse to take on trampoline liability and exclude the item from coverage.

Young people are usually very active online. However, using social media and other sites can increase the possibility of them directly or indirectly damaging someone's reputation and exposing you, the parent, to a lawsuit.

Your homeowners insurance policy includes liability coverage for property damage caused by any member in the family, but likely does not cover rumors or statements that damage a reputation. You may need to seek additional coverage to include liability protection that covers personal injury or defamation.

You invite guests over for a pool party and one of your guests dives into the shallow end of the pool and is permanently injured. They hire a lawyer to represent them and after a long legal battle, you and your family are left financially responsible for their injuries. Do you have enough money in savings to cover your legal responsibilities as well as the legal defense costs?

An umbrella or excess liability policy increases your personal liability limits by adding protection over and above your current auto, boat, or homeowners policies-providing financial value and security. Excess liability insurance is available either by an endorsement to your homeowners policy or available as separate coverage.

You do not have to live near a body of water to suffer loss due to flooding. With the changing weather patterns and more damaging storms occurring around the globe, flood losses are becoming more common in places that are not normally prone to flood damage. Your homeowners policy does not cover damage from flood. Could your home be at risk?

Purchase a flood insurance policy to protect your home and covered contents from certain types of flood losses as designated by the National Flood Insurance Program. A flood policy is purchased as a separate policy through the federal program (NFIP) or through a servicing carrier known as a write your own carrier.

Owning a secondary home has the potential of increasing your liability exposures.

Be certain that you extend the liability coverage under your homeowners policy to include your secondary home. You should also consider including the secondary home under an excess liability or umbrella policy to provide for additional liability limits.

Collector or classic vehicles often have significant value and require special documentation and unique insurance coverage to ensure they are adequately protected. Even if stored on your property, they are typically not covered under your homeowners insurance.

Insure your collector cars with a specialized insurance company that focuses on and understands the unique nature of collector or classic cars and other vehicles.

If you are a connoisseur of wine, you know that it is susceptible to outside environmental exposures that can ruin it. If the collection is damaged, coverage from your homeowners policy is a possible recourse. However, the damage is only insurable if it is a covered cause of loss as outlined in your homeowners policy. A deductible would also apply.

If you have a sizable wine collection, you may want to consider scheduling the collection on your homeowners policy. Doing so expands your coverage and eliminates the deductible in case of a loss. You can also consider unique coverages for wine, such as for spoilage.

Whether entering from outside your home from a flood or from within your home’s plumbing system, water damage is the most common cause of loss to a home. Many policies exclude losses caused by backup of sewers and drains, and all unendorsed homeowner policies exclude damage caused by a flood.

Careful review is essential to protect your home and belongings from all sources of water damage. We recommend coverage solutions from insurance companies that include backup of sewers and drains. Also, identify cost efficient solutions to address the risk of flood damage in the first place.

Surprisingly, standard auto insurance does not cover personal property or contents stolen from your car.

Most homeowners policies offer an option to include off-premises theft coverage as an endorsement, which covers you for theft of your personal property away from your residence.

Clickable Coverage

Educate Using Interactive Graphics

Discover Clickable Coverage, the insurance industry’s premier sales tool that revolutionizes consumer education. Our interactive graphics provide a fresh, engaging experience that goes beyond price-focused discussions. Say goodbye to outdated PDFs and brochures.

Give it a try!

50+ Graphics and Counting

Your Forge website comes packed with dozens of interactive graphics, with more on the way!

Video Proposals

Close Deals With Personalized Video Proposals

Record screen and webcam presentations to explain insurance options, policy terms, and renewals. Impress clients with a personal touch.

Hello Producer

Showcase Your Team’s Personal Touch

Highlight individual team members with a special link, displaying their photo and contact information across your website.

Power Panels

Build Trust and Credibility

Feature testimonials, 5-star ratings, and news with attention-grabbing Power Panels to reinforce your agency’s credibility.

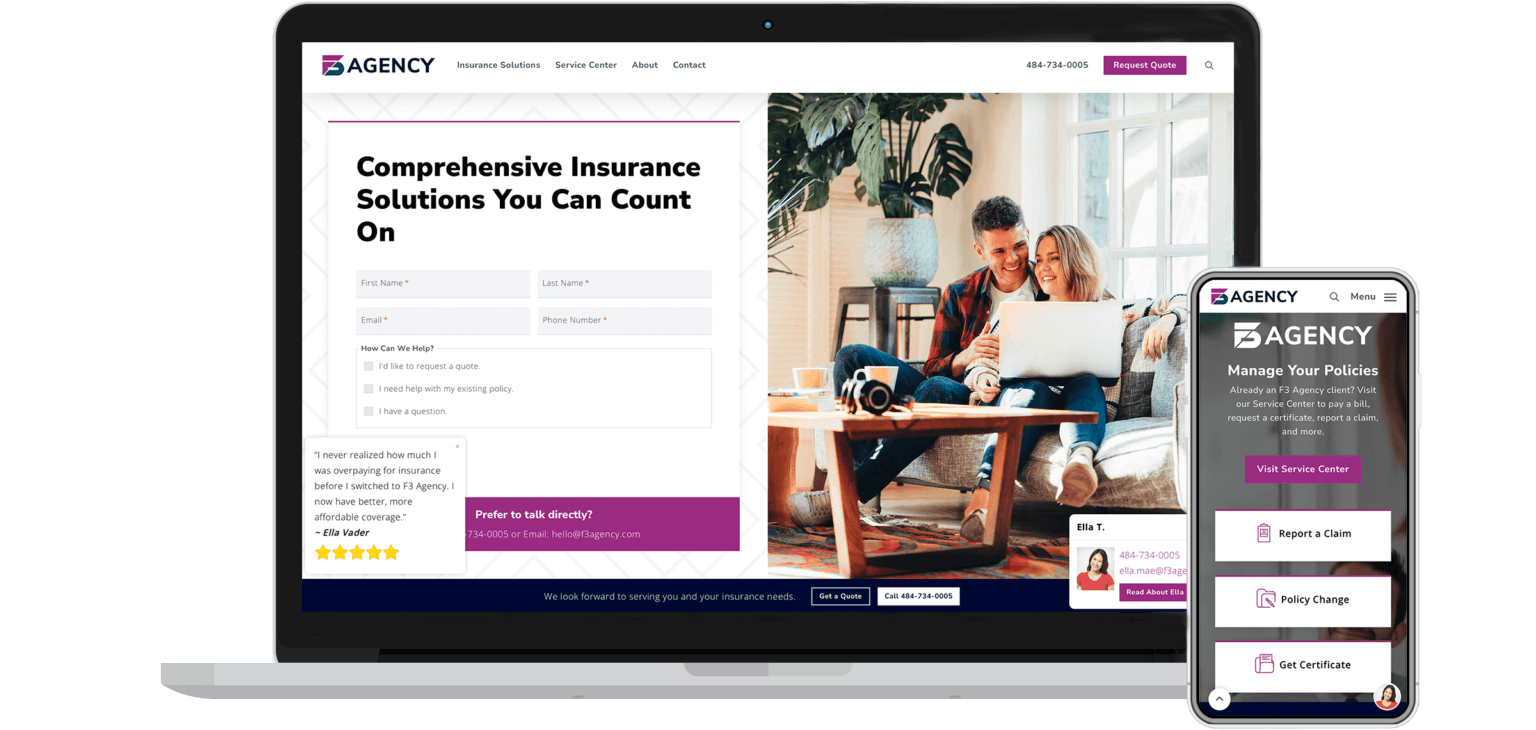

Lead Capture Forms

Never Miss a Lead

Forge’s conversion-optimized Lead Capture Forms ensure you’ll never miss an opportunity again. They also integrate with AMS360, QQCatalyst, and Hawksoft.

Video Library

Share Engaging Content

Our ever-growing Video Library helps you showcase your insurance expertise and engage your audience.

Service Better

Exceed client expectations by delivering exceptional service every time.

Offer impressive client features and a streamlined service center. People expect to be able to engage with you online, so give them what they want.

Streamline Client Service Requests

Make life easier for your clients. The 24/7 Client Service Center includes options for reporting a claim, making a policy change, requesting a certificate, requesting an auto ID card, paying a bill, and more.

Simplify Policy Reviews and Renewals

Identify coverage gaps by having clients complete the elegant Policy Review Form online prior to policy renewals. It’s designed to capture important details and make sure you offer the appropriate insurance coverage.

Chat Online

Did you know that 75% of website visitors prefer live chat over calling to speak with an agent? Answer questions and engage with prospects right from your Forge website with Live Chat.

Share Important Updates

Notification Bars offer a convenient way to tell people you’re closed for the holiday, you’ve moved locations, or how to file a claim if a big storm is coming. Or, leave it up all the time to drive more quote requests.

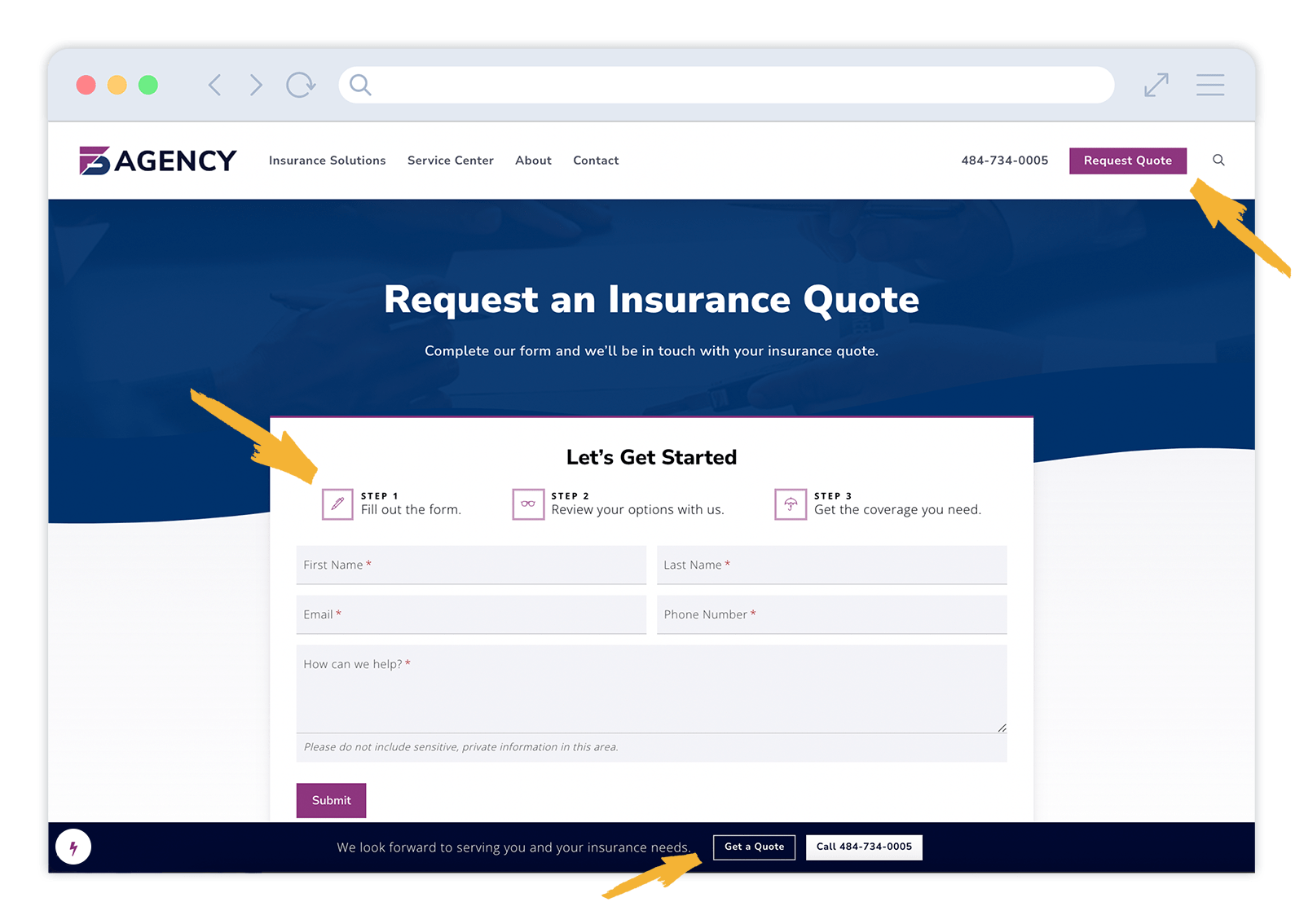

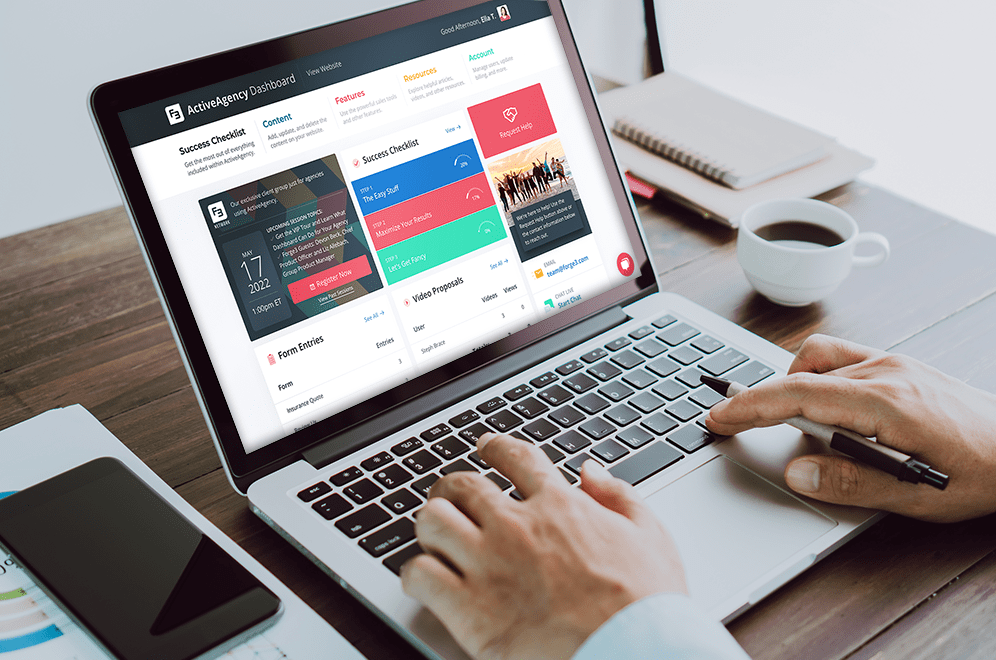

Forge Dashboard

Manage everything effortlessly.

Dashboard is your central hub for all things Forge.

It’s never been easier to use all the powerful sales tools and built-in features. You’re not a web expert, and you shouldn’t have to be. Dashboard makes it easy to manage your site and get help when you need it.

Use the Features

Use the interactive Success Checklist to get the most out of Forge and maximize results.

See How You’re Doing

Access form submissions, see team leader boards, and view website performance metrics.

Get Unlimited Help

Contact our award-winning, human-powered team for help and guidance along the way.

Power your insurance agency with Dashboard.

Easy, secure access to everything you need to get the most out of Forge.

Clickable Coverage

Video Proposals

Hello Producer

Power Panels

Notification Bars

Service Center / Forms

5-Star Reviews

Live Chat

Integrations

Directory Listings

Content Pages

Blog Posts

Office Locations

Team Members

Carriers

Power your insurance agency with Dashboard.

Easy, secure access to everything you need to get the most out of Forge.

Clickable Coverage

Video Proposals

Hello Producer

Power Panels

Notification Bars

Service Center / Forms

5-Star Reviews

Live Chat

Integrations

Directory Listings

Content Pages

Blog Posts

Office Locations

Carriers

Team Members

Ready to get started?

Request more information about Forge, websites designed specifically for independent insurance agencies.